Health Savings Accounts

Access Your AccountHealth Savings Accounts for peace of mind.

Be financially prepared for every healthcare cost that comes your way. United HSAs are available through your employer’s benefit plans. If you’ve already enrolled in a United HSA, you can access your account here:What’s a Health Savings Account?

Why should I open an HSA?

Then, at age 65, you’ll be able to use the funds you’ve saved in your HSA for both qualified and nonqualified expenses. The nonqualified expenses will be taxed, but you won’t receive the 20% penalty that’s incurred before the age of 65.

Easy HSA Enrollment

1. Enroll

2. Participate

3. Contact Us

The Benefits of Saving with United

Your United Health Savings Account (HSA) comes with:

- No minimum balance

- Free HSA debit card

- Digital banking access

- Personalized HSA portal with your tax savings to date, transaction details, and receipt storage

- Monthly eStatements and annual reports

- One-time $10 setup fee and $2.75 monthly service charge

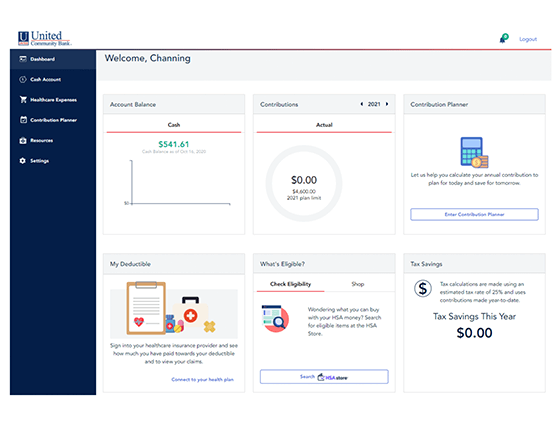

Your HSA Portal

Stay up to date with your expenses and progress at all times. Enroll in our HSA portal to:

- View your account balance, tax savings, and contributions

- Track your out-of-pocket expenses and store your receipts

- Plan your contributions to meet your current needs and see how much you can save by retirement

- Link your healthcare plan and track your deductible, out-of-pocket maximums, and medical claims

HSA Contributions

| Year | Individual/Single Coverage | Family Coverage (2+ Lives) | Catch-up Contributions2 |

|---|---|---|---|

|

Year

2024 Contributions

|

Individual/Single Coverage

$4,150

|

Family Coverage (2+ Lives)

$8,300

|

Catch-up Contributions2

$1,000

|

|

Year

2025 Contributions

|

Individual/Single Coverage

$4,300

|

Family Coverage (2+ Lives)

$8,550

|

Catch-up Contributions2

$1,000

|

Learning Resources

-

To be eligible for an HSA account you must be enrolled in a High Deductible Health Plan (HDHP), cannot have additional healthcare coverage including Medicare or VA benefits and cannot be claimed as a dependent. HSA accounts cannot be rolled or transferred into any IRA account.

2Those age 55 and older may contribute an additional amount as shown as a catch-up contributor.